In addition to the above, there is a discount relief for individuals buying their first home from 23 September 2022. This means that there will be no SDLT payable on first homes up to the value of £425,000 and 5% is due to be paid on properties between the value of £425,001 and £625,000.

If the value of the property is over £625,000, you cannot claim SDLT relief and should follow the rules for existing homeowners.

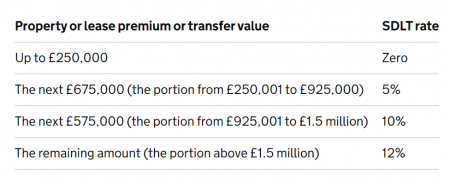

Depending on your circumstances, the tax thresholds change, for example, the price of the property and whether you are buying an additional property will impact the amount of tax you pay.

Second homes

As of 31 October 2024, when it comes to purchasing a second home, the higher additional rates remain with a 5% higher rate on top of these standards. So, if you are purchasing a holiday home up to the threshold value of £250,000 you will pay 5% SDLT. Those buying a second home over the threshold will pay 10% on the portion from £250,001 to £925,000, 15% on the portion from £925,001 to £1.5 million, and 17% on the remaining portion over £1.5 million.

Visit gov.uk for more information

New leasehold sales and transfers

On new leasehold sales and transfers, you will pay SDLT on the purchase price of the lease using the rates above. If the net present value is higher than the SDLT threshold, 1% SDLT is to be paid on the portion over £250,000.

As there are many different types of stamp duty tax, we have created a stamp duty calculator to help you work out how much you will have to pay for the property you buy. Simply fill out the purchase price and see what your tax will be.

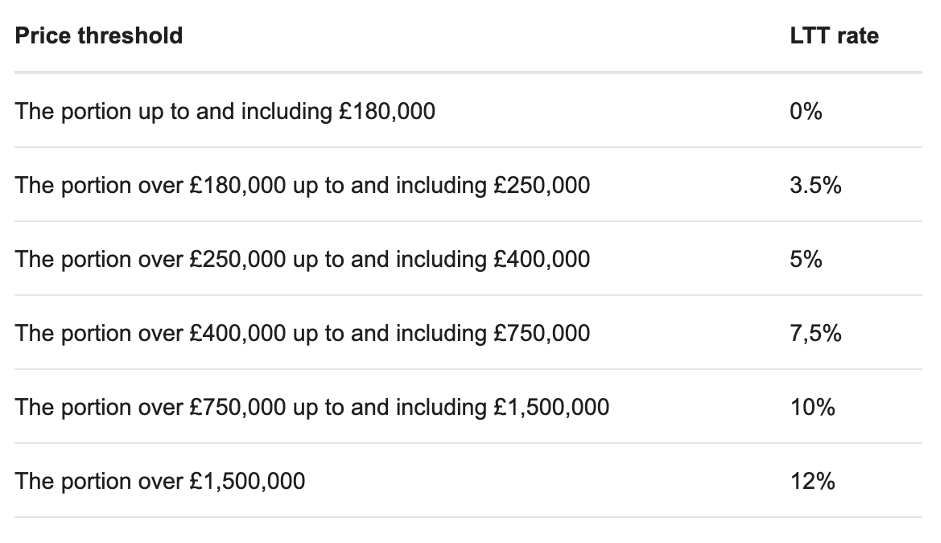

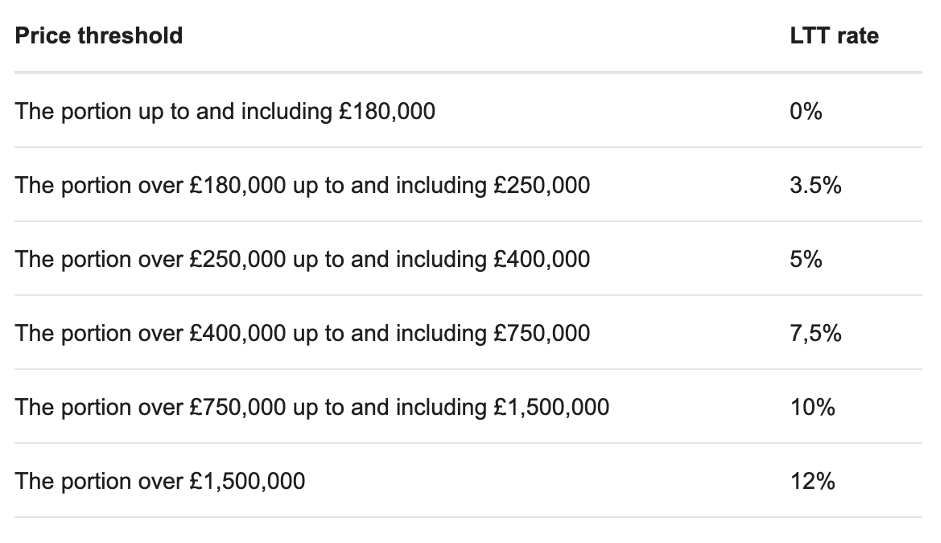

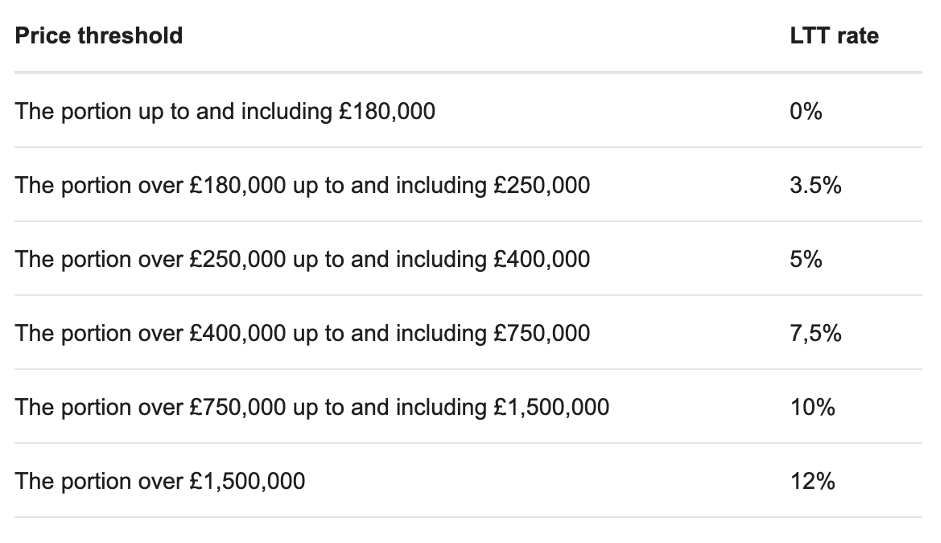

Land Transaction Tax in Wales

Land Transaction Tax (LTT) is payable when you buy or lease a building or land over a certain price in Wales. No tax is paid on the first £180,000 of a property, however, it increases to 3.5% up to £250,000, 5% up to £400,000, 7.5% up to £750,000, 10% up to £1,500,000, with any amount thereafter taxed at 12%.

Higher residential tax rates

A 4% surcharge applies to transactions involving the purchase of an additional property up to £180,000. This includes second homes and buy-to-let investments. A surcharge of 7.5% applies to properties in the threshold of £180,001 to £250,000, a 9% surcharge on properties between £250,001 and £400,000, 11.5% on properties between £400,001 and £750,000, 14% on properties between £750,001 and £1.5m and a 16% surcharge thereafter.

LTT does not apply to rents payable under a lease for residential property.

If you already own at least one residential property, you may need to pay the higher residential rates when you purchase a residential property.

If you are replacing your main residence, the higher rates may not apply.

Land and Buildings Transaction Tax in Scotland

Land and Buildings Transaction Tax (LBTT) operates slightly differently to SDLT in England and Northern Ireland or LTT in Wales, as it requires buyers to pay tax on amounts between bands, as opposed to the full purchase price of a property.

The following changes have been made as of 1 April 2021.

The first £145,000 will be exempt from tax when purchasing your primary property. Between £145,001 and £250,000, you will pay 2% LBTT, and then 5% on the amount between £250,001 and £325,000, and then 10% on the amount between £325,001 and £750,000 with any amount thereafter taxed at 12%.

Since 30 June 2018, first-time buyers in Scotland have benefited from a relief on LBTT. This raises the zero-tax threshold for first-time buyers from £145,000 to £175,000. From 1 April 2021, the availability of the relief will result in a reduction in tax of up to £600 for qualifying first-time buyers, relative to the rates which would have otherwise applied.

To find out how much you will need to pay for your new home, fill out our Stamp Duty Calculator form, selecting where you will be buying the property from the dropdown of options.